LTV metrics can be helpful in forecasting profits and revenue generation trends.

Moreover, LTV helps in resource allocation and the preparation of budgets. If a customer continues to purchase for a longer period, their lifetime value increases.

It could also be thought of as a key metric in the customer experience program.

An estimate of how much a person is likely to spend on your product or company helps in developing business strategies and decision-making.

Let's look at the topic that we will cover in this blog:

- What is customer lifetime value?

- Why customer lifetime value?

- Importance of customer lifetime value?

- Uses of lifetime value

- Customer lifetime value models

- How do you calculate a lifetime value?

- Ways to increase the customer lifetime value

What is customer lifetime value?

LTV stands for "lifetime value," and the customer lifetime value refers to the total revenue/worth or value in monetary terms that the customer gives to a business throughout their relationship.

It is called a "lifetime value" because it takes into consideration the revenue generated by a customer throughout their "lifetime as a customer."

This in turn depicts the worth of the customer and specifies the value they add to a business during their customer journey.

Why customer lifetime value?

Customer lifetime value enables the company to improve its performance so as to keep its customers for longer.

Customer lifetime value is enhanced through the customer experience. This metric paves the way for the company to provide better services to its customers.

The going concern aspect of a business is augmented through increasing customer lifetime value.

A clear picture of the financial viability of the company can be derived through LTV. Furthermore, LTV indicates how well a product/service is performing in the market.

It shows the interest of customers in the products offered by the company. In addition, it signifies customer loyalty to the brand, which aids in forecasting revenue for the business.

Importance of customer lifetime value

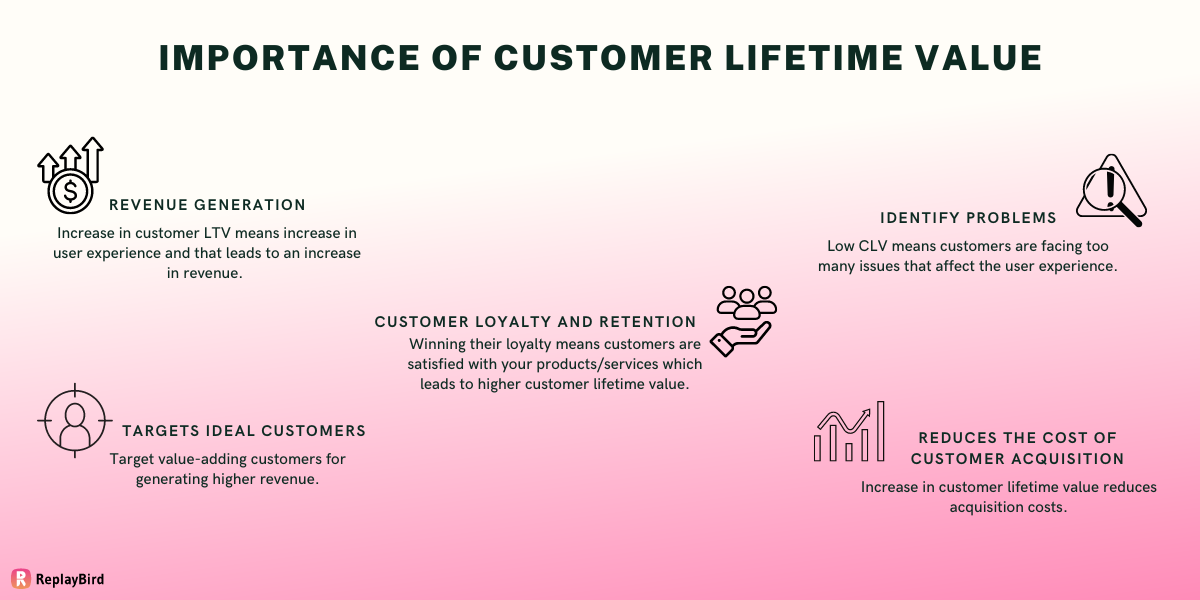

1. Revenue generation

Lifetime value denotes the value customers add to your business, which ultimately is the revenue of your company.

When the lifetime of a customer is long, they bring in more revenue. When customers who add value to the business are identified, it becomes easier for the company to track and improve performance.

Such customers can be served with care so as to give them satisfaction which will keep them loyal customers to your brand. Hence, an increase in customer LTV leads to an increase in revenue.

2. Identify problems

When a customer's lifetime value is low, it indicates that customers are not satisfied with your products/services.

This important indicator denotes the need for improvement in products or any other aspects of the business.

It could be solving an issue that a customer is facing, for example, solving a bug in the application software.

3. Customer loyalty and retention

The higher customer lifetime value signifies that customers are satisfied with your products/services.

By keeping this in mind, the company can put in extra effort to retain customers by winning their loyalty.

4. Targets ideal customers

Customer lifetime value shows the customers who invested their money into your business by making a purchase.

Thereby, this shows the ideal customers who wish to spend their money for the value you provide.

With this information, the company can target these kinds of value-adding customers for generating higher revenue through the formulation of strategies and product development.

5. Reduces the cost of customer acquisition

Customer acquisition is an expensive process since it requires a great deal of marketing effort.

Through the information from Customer Lifetime Value, the company can maintain stable strategies to retain customers who are already in hand so as to reduce the need for acquiring new customers.

It is to be noted that an increase in customer lifetime value reduces acquisition costs.

Uses of lifetime value

The LTV metric is used for important business analysis. They are as follows:-

1. Revenue forecast

LTV shows the revenue a customer contributes to the business. This in turn helps to predict the revenue of a business based on past profits and trends in customers' purchases.

Moreover, a stable level of income can be gained from retaining or rewarding loyal customers whose lifetime value is higher.

2. Preparation of budgets

The value of the customer determines the company's operations. It shows if customers are interested in your products/services and whether they wish to spend their money on your brand.

This information is helpful for businesses to allocate resources for improving their operations.

Based on the results of LTV, the business can choose to prepare its budgets around strategies so as to retain customers.

3. Business strategies

LTV is useful in formulating strategies for improving the operational efficiency of the business.

The know-how of techniques is determined through LTV, which helps in attracting customers. Marketing strategies could be developed based on the LTV.

This, in turn, leads to a reduction in the cost of customer acquisition and an increase in customer LTV.

Customer lifetime value Models

There are two different models that can be used to determine customer lifetime value.

The outcomes differ based on the model being used. Here, one model is based on past data, whereas the other tries to predict the future behavior of customers based on current data/situations. Let's see them in detail.

1. Historical customer lifetime value

This model is based on pre-existing data to determine the value of the customer. This avoids the question of whether the customer will continue with the company or not.

Here, the average order value is considered to find out the LTV. This model is very helpful for businesses whose customers interact with them only for a certain period of time.

This model has certain drawbacks since it does not consider:

a) Active customers - Historical data does not consider the currently active customers, because of which the data might become redundant.

b) Reactivated users/customers - It refers to inactive customers who might become active again. Historical data labels them as "inactive" and forgets the fact that they might be reactivated.

2. Predictive customer lifetime value

Here, the company tries to determine the buying behavior of customers in the future. It is done through an analysis of prevailing circumstances in the company.

This helps in identifying:

- Customers who are most valuable to your business

- Products or services that perform well in the market i.e.., bring in more revenue

- Customer retention strategies

How do you calculate a lifetime value?

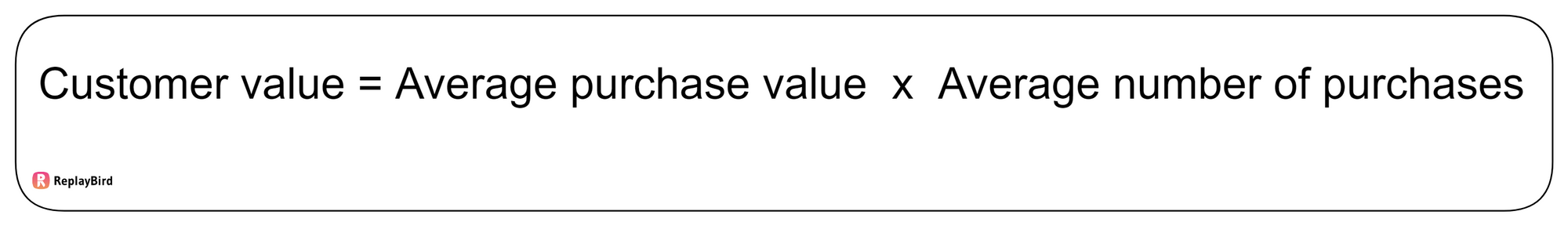

To find customer LTV, you must first find customer value. Customer value is the product of average purchase value and the average number of purchases, which is,

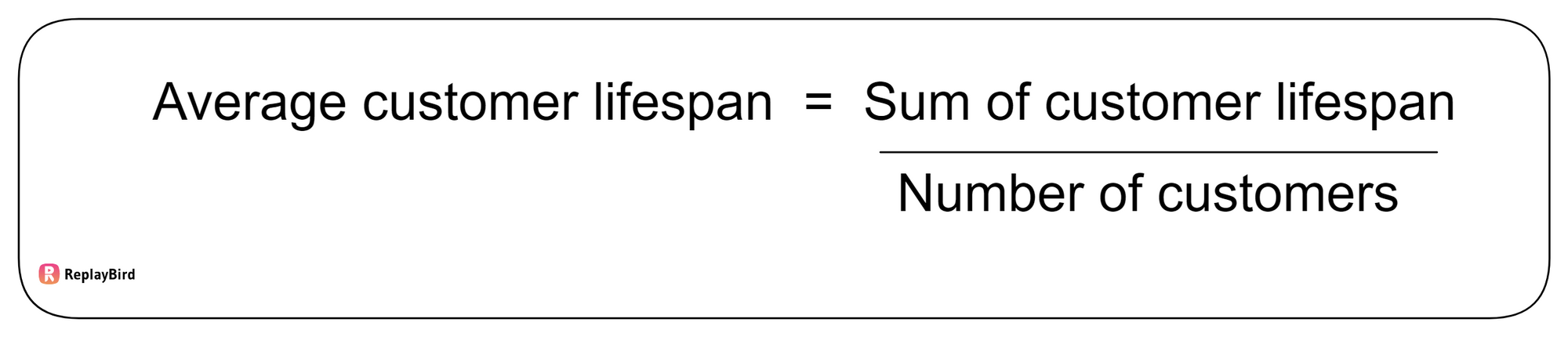

To find the average customer lifespan, you must add all the customer lifespan and divide by the total number of customers, which is,

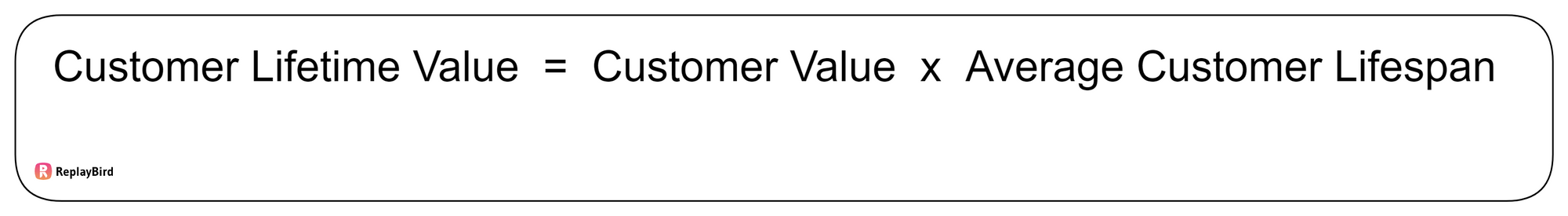

Now, we can calculate the lifetime value by multiplying the customer value by the average customer lifespan, which is,

From this, it can be understood that the calculation of customer lifetime value has two components attached to it.

Let's see them in brief, to understand the formula better.

1. Customer value

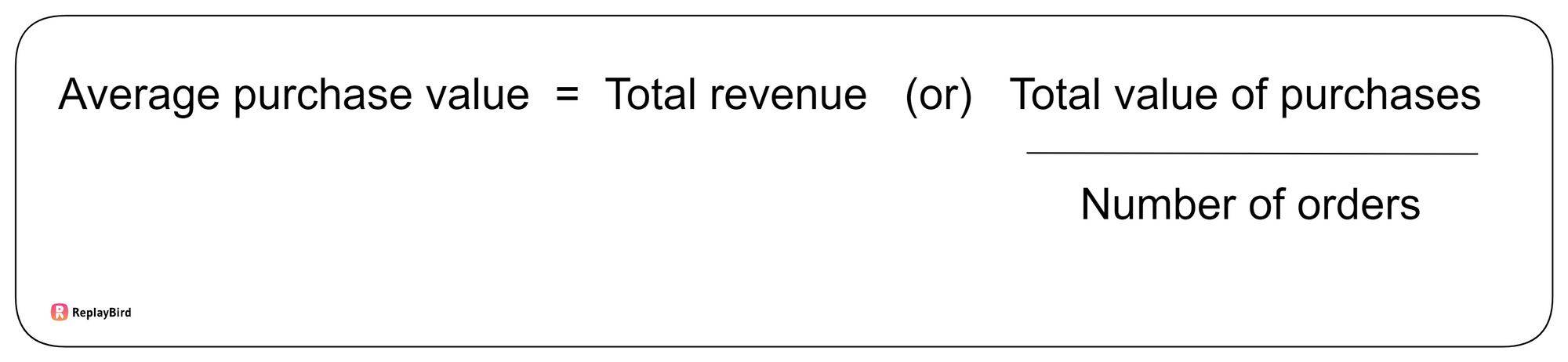

The average purchase value refers to the total value of purchases divided by the number of orders. It could be thought of as the average sales value of each sales transaction.

The average purchase value could be calculated for a day, week, month, or even year based on your business model.

This implies

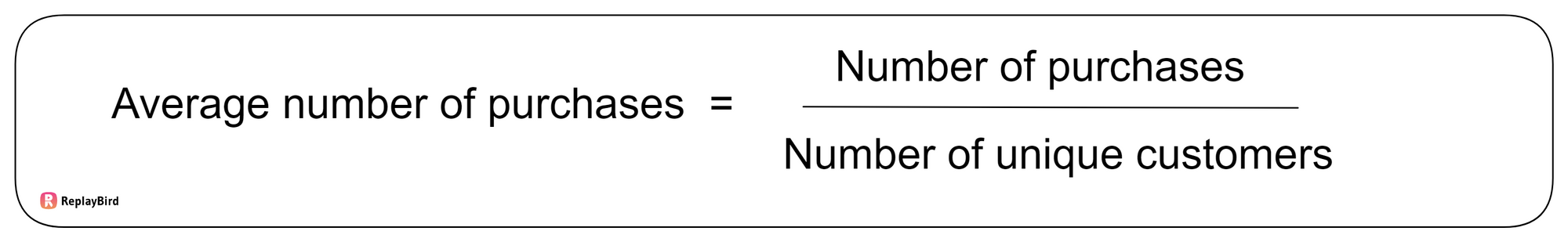

Next, we can calculate the average number of purchases by dividing the number of purchases by the number of unique customers (customers who made purchases during that period).

This implies

The product of the average purchase value and the average number of purchases would give us the customer value.

2. Average customer lifespan

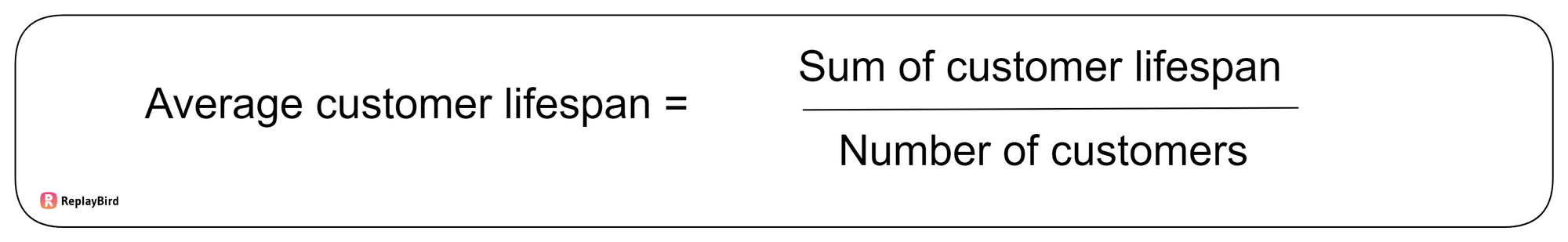

This gives the timeframe of customers that the company holds. The lifespans of all the customers should be added together and then divided by the total number of customers to get the average lifespan of the customers.

This is helpful in knowing where the company stands with respect to the lifespan of customers.

This implies

Ways to increase customer lifetime value

There are many ways that can be employed with the view of increasing your customer's lifetime value. Let's see them in brief.

1. Establish a framework for customer relationships

As a company, your goal must be to have a long-term relationship with your customers. To attain that, you need to develop a framework which would develop the customer interest in your products/service and make them come back to your products again.

This leads to customer retention, which can be earned by winning their loyalty. For this, your business needs to work on strategies that will gain the satisfaction of the customers.

Once customers are satisfied with your services, they'll be loyal to your brand, which in turn will increase customer lifetime value.

2. Focus on evaluation techniques

Evaluation is a vital process in promoting efficient control over your business.

Here is where feedback from customers plays an important role in correcting deviations from standard performance.

Customers are who the companies work for, which is why their viewpoint is highly essential to developing your standards.

Taking customers' feedback into consideration enables your business to provide them with satisfaction, which leads to an increase in customer lifetime value.

For instance, you can conduct a quick survey on your products with your customers, which will help you with performance analysis.

Moreover, you can ask for ratings for your products or services once they are delivered.

3. Customer satisfaction

Customer satisfaction is the key to business success. Once the customers are satisfied, they will become loyal to your brand, thereby increasing your revenue.

Knowing your customers well helps in providing them with the products or services they desire.

This can be achieved through market research, feedback, and responses from customers.

Keeping your customers happy can be achieved through:

- Providing quality products or services

- Price discounts

- Customer care services

- Timely response to customers

- Transparency and genuineness in customer dealing

4. Connecting with customers

Customers look forward to quick responses to their needs or queries from you. That is why it is important to provide quick contact services to your customers.

Details or queries on products, tracking of shipping, and feedback could be communicated, which would make the customers trust your business.

In the age of social media, customers look for a speedy response to their queries.

For this, your company needs to make arrangements to enhance customer satisfaction, which would lead to an increase in customer lifetime value.

Conclusion

Customer lifetime value is a wonderful metric for knowing the inherent details of customer behavior.

It provides you with an understanding of customers who are loyal and who have remained with your business for a long time, helping you to achieve your goals.

In conclusion, customer LTV is a useful metric to know the exact value that customers add to your business, which helps in business analysis, forecasting revenue, and the decision-making process.

Moreover, it helps in resource allocation and the preparation of budgets.

ReplayBird - Driving Revenue and Growth through Actionable Product Insights

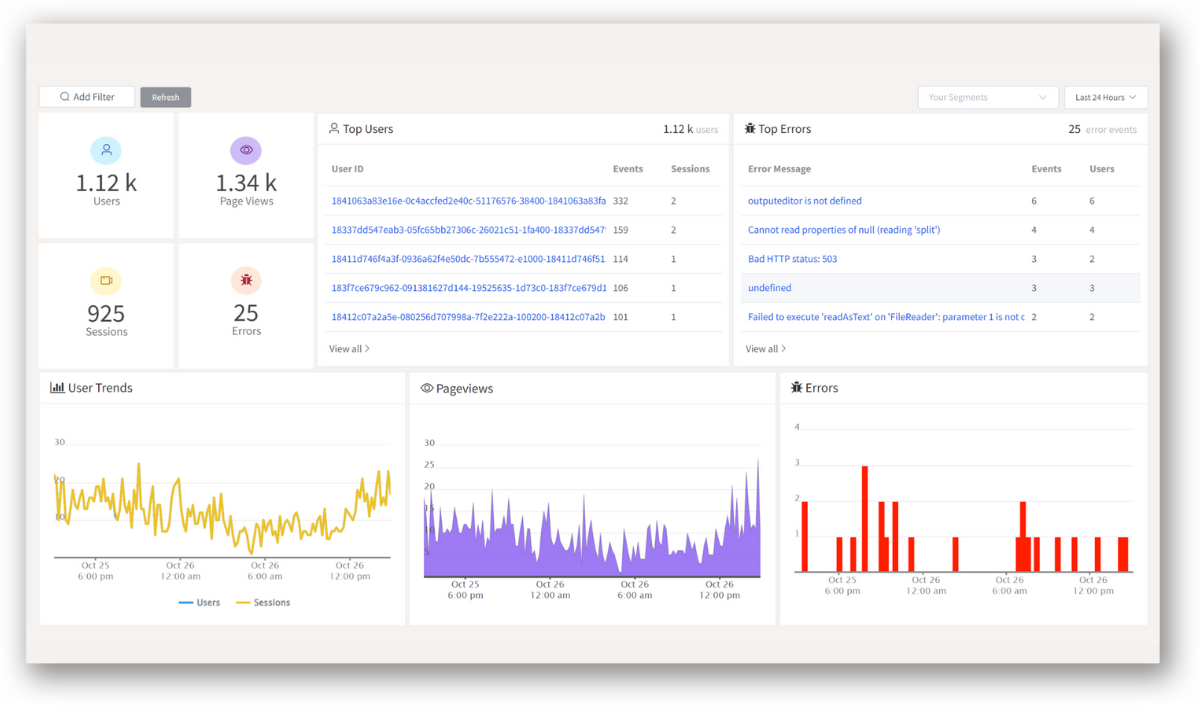

ReplayBird is a digital experience analytics platform that offers a comprehensive real-time insights which goes beyond the limitations of traditional web analytics with features such as product analytics, session replay, error analysis, funnel, and path analysis.

With Replaybird, you can capture a complete picture of user behavior, understand their pain points, and improve the overall end-user experience. Session replay feature allows you to watch user sessions in real-time, so you can understand their actions, identify issues and quickly take corrective actions. Error analysis feature helps you identify and resolve javascript errors as they occur, minimizing the negative impact on user experience.

With product analytics feature, you can get deeper insights into how users are interacting with your product and identify opportunities to improve. Drive understanding, action, and trust, leading to improved customer experiences and driving business revenue growth.

Try ReplayBird 14-days free trial

Further Readings: